From filing taxes to understanding allowable deductions, tax law affects almost every aspect of our lives. Whether it’s submitting returns as an individual taxpayer or dealing with the complexities of payroll taxation as a business owner, mastering tax law is essential for financial success. In this comprehensive guide, we will examine how federal and state legislation impacts personal and business finances in order to better understand the larger implications on an economy-wide level. We’ll start by exploring exactly what “taxes” are–what they mean in terms of income-generating activities and investments–then move on to the various forms of taxation available, their advantages and disadvantages, as well as how you can use them strategically for financial gain. Get ready – buckle up – this is going to be one informative ride!

Overview Of How Tax Law Affects Personal Finances

Tax law can have a significant impact on our personal finances, from the amount of money we take home in our paychecks to the deductions we’re able to claim for medical expenses or charitable donations. For many of us, taxes can be a source of stress and confusion, so it’s essential to stay up-to-date on the latest laws and regulations to make informed decisions about our finances. Some of the key areas to keep in mind include changes to tax brackets, tax credits, deductions, and exemptions. By taking the time to understand the impact of tax law on our personal finances, we can make informed decisions that help us to save money and achieve our financial goals. With tax law assistance services it’s easier than ever to take the guesswork out of filing taxes and maximize our returns. When in doubt, it’s always best to consult with a professional to ensure that you’re taking advantage of every deduction and credit available.

Understanding Your Tax Responsibilities As A Business Owner Or Employer

As a business owner or employer, understanding your tax responsibilities is crucial to the success of your organization. Navigating the complex world of tax law can be daunting, but it is essential to ensure that you are fulfilling your duties and avoiding any potential legal issues. Keeping accurate records, knowing which taxes apply to your business, and submitting filings and payments on time are just a few of the many responsibilities you will have as a tax-paying entity. While it may seem overwhelming, taking the time to educate yourself can save you money and headaches in the long run. With a little bit of effort, you can confidently manage your tax responsibilities and focus on growing your business.

Exploring The Different Types Of Taxes And Their Impact On Businesses

Understanding taxes is a crucial aspect of running a business. There are different types of taxes that businesses are subjected to, including income tax, sales tax, payroll tax, and property tax. Each tax type has its unique set of rules and regulations, and compliance requires a thorough understanding of tax laws. The impact of taxes on businesses can vary depending on the size and nature of the entity. For larger businesses, taxes can impact profits and limit growth potential. Small businesses, on the other hand, may struggle to keep up with the tax burden, leading to difficulties in managing cash flow. Despite the challenges, businesses should nonetheless learn about the types of taxes and how to comply with them, as avoiding or evading taxes can lead to legal consequences and harm the company’s reputation.

Navigating The Complexities Of Filing Taxes As An Individual Or Business

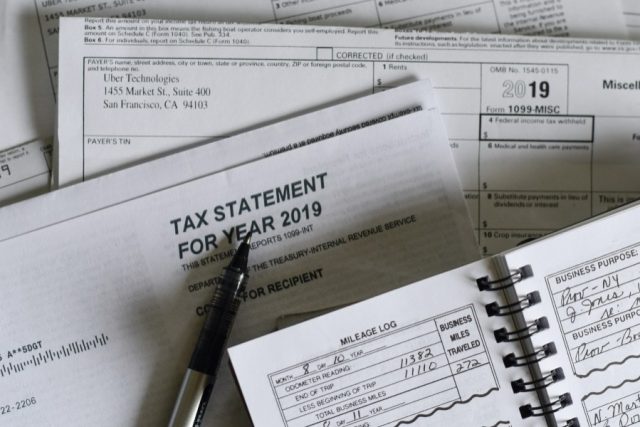

Filing taxes can seem like a daunting task, whether you’re filing as an individual or a business. The complexities of tax codes and regulations can leave even the most experienced filers feeling overwhelmed. However, it’s important to navigate these complexities and ensure that you’re maximizing your deductions and staying compliant with all applicable laws. From determining your filing status and gathering all necessary documentation, to understanding deductions and credits, filing taxes requires attention to detail and careful planning. While it may be tempting to put off this task until the last minute, taking the time to properly file your taxes can save you significant time, money, and stress in the long run.

Strategies For Minimizing Tax Liabilities

Taxes are a fact of life, but that doesn’t mean we have to accept them without thinking strategically. There are a number of ways to minimize your tax liabilities, and it begins with being proactive rather than reactive. One approach is to plan ahead and utilize tax-deferred accounts, such as 401(k)s or IRAs, to lower your taxable income. Additionally, taking advantage of deductions and credits can lower your overall tax bill. It’s important to stay informed about changes in tax laws and how they may affect you, and enlisting the help of a financial advisor or tax professional can be a smart move. By taking a thoughtful approach to your taxes, you can keep more of your hard-earned money in your pocket.

Benefits Of Consulting With A Professional In The Field Of Tax Law

Navigating the complex world of tax law can be overwhelming for anyone, regardless of their experience or knowledge. It’s a maze of legal jargon and regulations that even the slightest misstep can result in costly consequences. That’s why consulting with a professional in the field of tax law can have numerous benefits. Not only can they provide expert guidance and legal advice, but they can also help you navigate through the legal complexities of tax law and make sure you are compliant with all regulations. Additionally, they can help you identify opportunities for savings and maximize your tax benefits. By having a professional by your side, you can have peace of mind knowing that your tax affairs are in capable hands.

Tax law is a complex subject and often changes from year to year. Regardless of what category you or your business falls into, understanding the complexities of taxation and how it associates with personal finances is vital for avoiding penalties when filing taxes. This delicate topic can get overwhelming quickly, so consider consulting with an experienced professional in the field to ensure you’re getting the most out of your investments.

Whether starting a business or simply managing your annual taxes as a regular citizen, being cognizant of tax laws could save you precious dollars in the long run. Doing a thorough investigation into state and federal laws can give an individual and businesses confidence that they are managing their money and resources effectively and efficiently while avoiding potential pitfalls along the way. Ultimately, becoming knowledgeable about taxation laws on both state and federal levels is absolutely essential for success.