House GOP Advances New Tax Legislation That Could Alter American Finances

In an important step forward for tax reform, the House Ways and Means Committee has approved a Republican-supported bill that proposes several significant changes to the current tax landscape. This measure not only aims to make former President Donald Trump’s 2017 tax cuts permanent but also introduces various new deductions and breaks that could affect millions of American taxpayers.

Key Features of the Proposed Tax Cuts

The recently passed legislation is designed to extend the benefits of the 2017 Tax Cuts and Jobs Act (TCJA), thereby preventing a potential tax increase for over 60% of filers in 2026. The committee projects an average tax reduction of approximately $1,300 for taxpayers.

Below are some of the pivotal tax changes included in the proposed bill:

| Tax Change | Description |

|---|---|

| New Deduction for Seniors | $4,000 deduction for filers 65 and older, with income limits. |

| Increased Standard Deduction | Single filers: $16,000; Head of households: $24,000; Married couples: $32,000. |

| Extended Child Tax Credit | Increases to $2,500 per child until 2028, before falling back to $2,000. |

| Elimination of 1099-K Reporting | Removes the need for payment platforms to report small transactions to the IRS. |

| Pass-Through Deduction Increase | Increases the small business deduction from 20% to 23%. |

| Tax Elimination on Tips | Eliminates taxes on tipped income, effective until 2028. |

| Car Loan Interest Deduction | Allows a $10,000 deduction for interest paid on auto loans. |

Legislative Path Forward

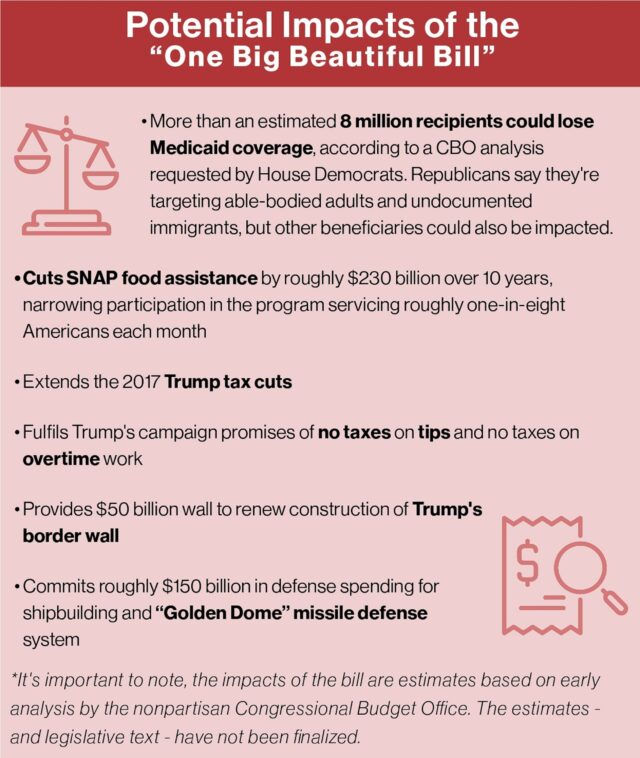

As the bill continues through Congress, it will likely see revisions, particularly in response to the resistance from Democratic lawmakers. They have raised concerns regarding proposed cuts to essential programs such as Medicaid and the Supplemental Nutrition Assistance Program (SNAP). These cuts are part of a broader GOP strategy aiming to realize $880 billion in savings to offset the tax cuts.

House Speaker Mike Johnson expressed a commitment to progressing the legislation swiftly, with plans to deliver it to the Senate by Memorial Day. However, the discussion surrounding the bill remains contentious, with Democrats highlighting discrepancies in the permanence of tax breaks for wealthier individuals versus the temporary nature of those aimed at the middle and lower classes.

Conclusion

As discussions evolve and the legislation moves forward, the outcome will undoubtedly influence the financial landscape for many American households. With various proposed deductions and tax breaks, how these changes are finalized could reshape fiscal obligations for years to come.